- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Should You Invest Like Michael Burry and Buy This New IPO Stock Here?

Michael Burry has been well-known in Wall Street circles for decades, but he didn’t really break into the mainstream until The Big Short movie, based on the 2010 book of the same name, highlighted his successful bet to short subprime mortgage bonds before the 2008 housing crisis.

And it was at the end of that 2015 film that producers divulged that Burry “is focusing all his trading on one commodity: water.” That’s because the global water supply is under pressure. According to the World Wildlife Fund, less than 1% of the global water supply is fresh and accessible.

For investors who want to follow this trend, there’s a new pure-play opportunity—WaterBridge Infrastructure (WBI), a Houston-based company with assets in the Delaware Basin, announced the launch of its initial public offering. Starting today, Sept. 17, it is trading on the New York Stock Exchange under the ticker WBI. The IPO closes tomorrow, and the company plans to sell 27 million shares at $17 to $20, which would raise about $540 million.

The company is seeking an overall valuation of roughly $2.3 billion.

While Burry's Scion Asset Management portfolio doesn’t specifically include commodities or any water stocks today, the idea that water could be a contrarian bet persists among some investors. So, is this a good time to trade WBI stock and buy the IPO?

About WaterBridge

As the IPO just opened today, investors should take a closer look at WaterBridge before deciding to dive in. The company has the nation’s biggest produced water infrastructure network, providing water management solutions to oil and natural gas exploration and production companies. WaterBridge does it all, handling the gathering, transporting, and recycling of water.

The company charges produced water handling fees for transporting water for disposal into its produced water handling facilities. It also provides raw or recycled produced water to customers for reuse in drilling and completion operations. The company says its revenue is tied to the long-life production of oil and natural gas wells rather than drilling activity. That’s important to note, as drilling can be cyclical, but the maintenance of oil and gas wells means a consistent customer base—and consistent revenues.

In the Delaware Basin, WaterBridge maintains 167 water facilities and nearly 1,800 miles of pipeline, handling 2.2 million barrels of water per day. The company has 3.9 million in produced water handling capacity, which indicates plenty of expansion opportunities.

WaterBridge also has some assets in south Texas and Oklahoma, giving it a total footprint of 2,500 miles of pipeline, nearly 200 facilities, and the capacity to handle 4.5 million barrels of water per day.

The company recently signed a long-term deal with BPX Production to support that company’s water needs. The agreement calls for WaterBridge to build and operate 400 million barrels per day of new water-handling capacity over the next three years. According to its SEC filings, it also has long-term contracts with Chevron (CVX), Devon (DVN), EOG Resources (EOG), and Permian Resources (PR).

The company has not yet decided if it will offer a dividend.

What Is the Outlook for WBI Stock?

The company is ideally situated, as the Delaware Basin, which is the most active subregion of the Permian Basin, is the most profitable oil and natural gas basin in North America. However, as management notes, companies that operate in the area face significant challenges, particularly from tariffs, labor and supply chain shortages, and global tensions.

But the industry has shown resilience so far. The compound annual growth rate of oil producers in the Delaware Basin was 21% from 2014 to 2024, management said. Water production increased with a CAGR of 19% in the same period.

“We believe that this growth in production activity will require increased produced water handling capacity, as the amount of produced water from wells in the Delaware Basin significantly exceeds the amount of the related oil and natural gas production,” management said in its SEC filing.

How Are Other Water Stocks Performing?

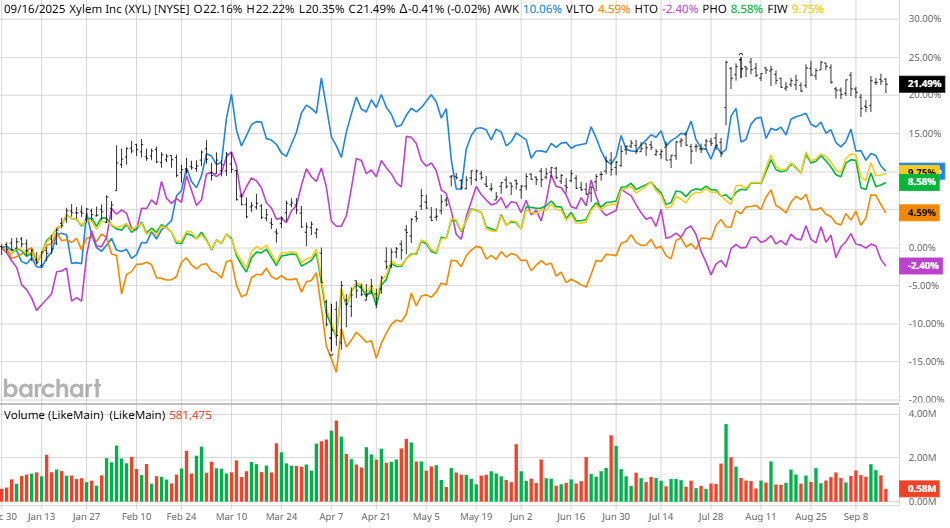

There are plenty of ways to invest in water, but the space isn’t consistently profitable right now. The best water stock over the last year is Xylem (XYL), which designs and builds equipment for the water industry. It is up 21% over the last year. On the other end of the spectrum is H2O America (HTO), a water and wastewater utility based in California that’s down 2.5% in the last 12 months.

It is to be seen if Burry himself takes a position in WaterBridge. That said, investors intrigued by the water theme will have their first pure-play IPO opportunity of the year here. Its long-term contracts with major energy companies give it a consistent revenue stream. However, this stock looks to be at best more of a safe defensive play than a growth stock. I would be more bullish if the board of directors introduced a strong, consistent dividend to make WaterBridge stock more appealing.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.